Is Real Estate Investing for Me?

Potential Advantages of Real Estate Investing

Investing in direct ownership real estate has many advantages over investing in stocks or other similar self-liquidating assets. Often, real estate markets are less volatile than stock markets while still offering similar or better returns. Real estate investments offer cash flow, appreciation in value, tax benefits, and offer equity growth through debt reduction. Real estate is a self-sustaining asset while stocks are a self-liquidating asset. For these reasons real estate remains one of the best options for securing financial freedom now and in retirement.While real estate can lead to financial freedom, a real estate investor must be able to quantify risk, value, cash flow, and understand valuations. This website is to inform both real estate investors and those interested in becoming real estate investors about commonly used formulas and provide an easy way to compute well established real estate financial measurements. While there are no guarantees in any investment, utilizing proven formulas can help you understand if a deal is right for you.

Ways to Generate Revenue and Equity Build Up in Real Estate

Cash Flow

Cash flow is the amount of income made from a real estate investment after all expenses have been paid (mortgage and NOI). Cash flow is generated from rent payments from rental properties and other related income opportunities (e.g parking spaces, storage spaces, etc...). Often, cash flow for a rental property will increase overtime; this occurs because the mortgage payments become smaller and the rental payments become larger over time.

Appreciation in Value

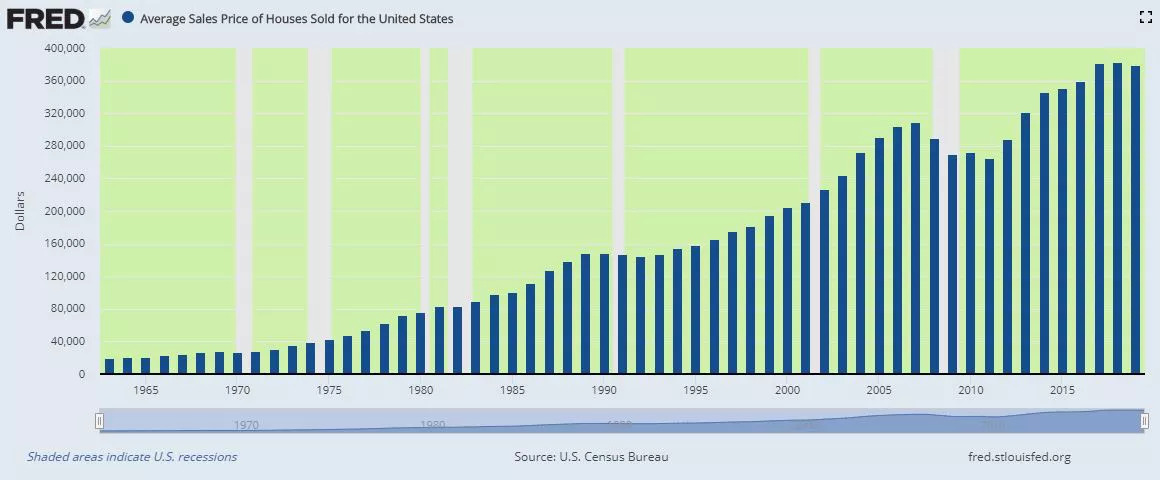

Real estate values tend to increase over time. As the figure below demonstrates house values have steadily increased since 1970.

Source: Federal Reserve Bank of St. Louis.

Tax Benefits

Here are a few tax benefits associated with real estate investments:

- Property depreciation is tax deductible.The IRS will allow you to deduct 3.636% of the value of the property each year.

- Mortgage interest tax is tax deductible.

- Cost of repairs, maintenance, property management, and utilities are tax deductible.

- Property tax is tax deductible.

Equity Build Up

Most properties are purchased using loans from banks or money lenders. A portion of the loan payment goes towards interest owed on the loan and a portion goes towards the principal. For every payment you make, the principal amount owed on the loan decreases; thus, increasing your equity.

By having your rental income pay off your mortgage, the renters are buying the property for you.